Medicare Insights Survey Results

Posted on December 14, 2020 |

The article was written by Jamie Sullivan, MPH, Danielle Boyce MPH, Kristen Willard, MS, Ruth Tal-Singer, PhD

The type of insurance you have can play a big role in what care you have access to and how much your care and medications cost. Since there are so many different types of insurance plans and because everyone has different considerations that are important to them, how people make choices, what types of things they think are important, and what resources they use to help them decide about insurance will be different for each person. We conducted the Medicare Insights Survey on COPD360social in October 2020 to find out answers to these questions and help us plan educational programs for 2021.

We heard from 192 people with chronic lung diseases who are currently covered by Medicare, Medicaid, private plans, and others. Here is the breakdown of the types of insurance that survey respondents have. Keep in mind that one person could select multiple options.

What matters in making insurance decisions?

Survey respondents were asked to select all the factors they think are important when they are choosing insurance plans and then to select the one most important factor.

We learned that more than 1 out of 3 people (37 percent) think that their ability to choose health care professionals without restrictions is the most important factor; however, expected monthly out-of-pocket cost was the most important factor for those who have Medicare Advantage Plans, which are run by private companies and often have fewer choices than people in Traditional Medicare.

"Monthly cost AND keeping my doctor."

--Survey respondent

We asked those who had Medicare Advantage to explain more about why those chose it and if they were happy with their choice. Almost 60% said they chose it due to it having the least expensive total monthly premium cost and 37.04% said it was the cheapest total monthly cost for medications. More than 1 in 4 were also swayed by the extra perks offered in Advantage plans and 29.63% said they could not afford the monthly costs for traditional Medicare and a Medicare Supplement Plan.

Most people said they were satisfied with the Medicare Advantage Plan and said they didn’t have to change much about their current health care team when they first switched.

"Do I really need a supplement?"

--Survey Respondent

For those who don’t chose Medicare Advantage, opting instead for traditional Medicare Part A/B, there are even more choices to make, and some have long-term consequences on out-of-pocket costs. We asked respondents that had Medicare Part A/B but NOT a Medicare Supplement Plan that typically covers most or all of the copays and coinsurance for Part A and B services if they had thought about purchasing one. More than one- third wrote in responses: 16.67% felt it was not necessary based on expected medical care needs and equal percentages (15.15%) suggested they were not aware of the options or the monthly premium was not affordable.

Unlike private insurance and most Medicare Plans, Supplemental Plans are not guaranteed issue after an initial enrollment period passes except in a few select states, yet this is generally not well understood. Guaranteed issue means that the insurance company has to sell you a plan even if you have pre-existing health conditions. Almost 40% of respondents said this was NOT explained to them. For those with COPD, not purchasing a Supplement Plan during the initial enrollment period can have big consequences so we will focus more on educating the community about the ins and outs of Supplement Plans and the tradeoffs to consider in future education efforts.

What About Open Enrollment?

Open Enrollment occurs each year in the fall (October-Early December) and it is the only time that people in Medicare can make changes to their Part D plans or change between traditional Medicare and Medicare Advantage, but

- 36% said that they do NOT review their Medicare coverage each year during the open enrollment period. Based on these results, the COPD Foundation will make sure that Medicare webinars and blogs will occur each year during open enrollment as to make sure everyone is well- informed.

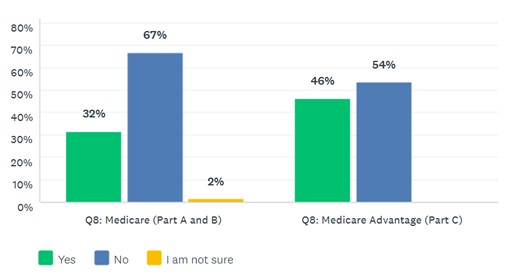

- Only 1 out of 3 respondents had made a change to their Medicare coverage since first enrolling, but more in Medicare Advantage had made a change then those with traditional Medicare Part A and B. Just under half said they made the change to lower their out-of-pocket costs and only 10% said they made a change to keep their lung doctor consistent with what we learned about the things people find most important in choosing their insurance.

Figure: Have you made changes to your Medicare coverage since you first enrolled?

What Types of Resources Help People Decide?

We also asked all respondents what resources they use to help them make insurance decisions and what might be most helpful to people with COPD as they enroll in coverage and during open enrollment. The most common resources used were family and/or friends, insurance broker, internet search and employer human resources. Many wrote in answers under “other “ including using the Massachusetts SHINE program, Medicare.gov, and help from a nurse.

We know there are high quality support services available to the community to help with general insurance questions; however, individuals with chronic diseases could benefit from an extra layer of support to understand how their health conditions should influence the factors to consider when making health insurance decisions. Nearly 65% of respondents indicated that a resource that details which types of care and treatments for COPD are covered by the different types of Medicare.

Understanding of what health services are covered by Medicare

Respondents were asked to identify the health care services covered by Medicare Part B and Part D as a measure of their general understanding of Medicare. A majority of respondents correctly identified ‘doctors’ appointments’ as covered by Medicare Part B; however, less than a third of respondents chose nebulizers and oxygen, both services that ARE covered under Part B, and 41% were ‘not sure.’ Responses were somewhat more accurate for Part D, with 67.7% correctly selecting ‘prescription drugs’ and 34.43% indicating they were ‘not sure.’ Based on the responses, we learned that there is limited understanding about the types of services covered by each type of Medicare.

In summary, the COPD Foundation will consider the survey results as we plan future educational topics and resources and encourage you to reach out and ask questions on COPD360social.